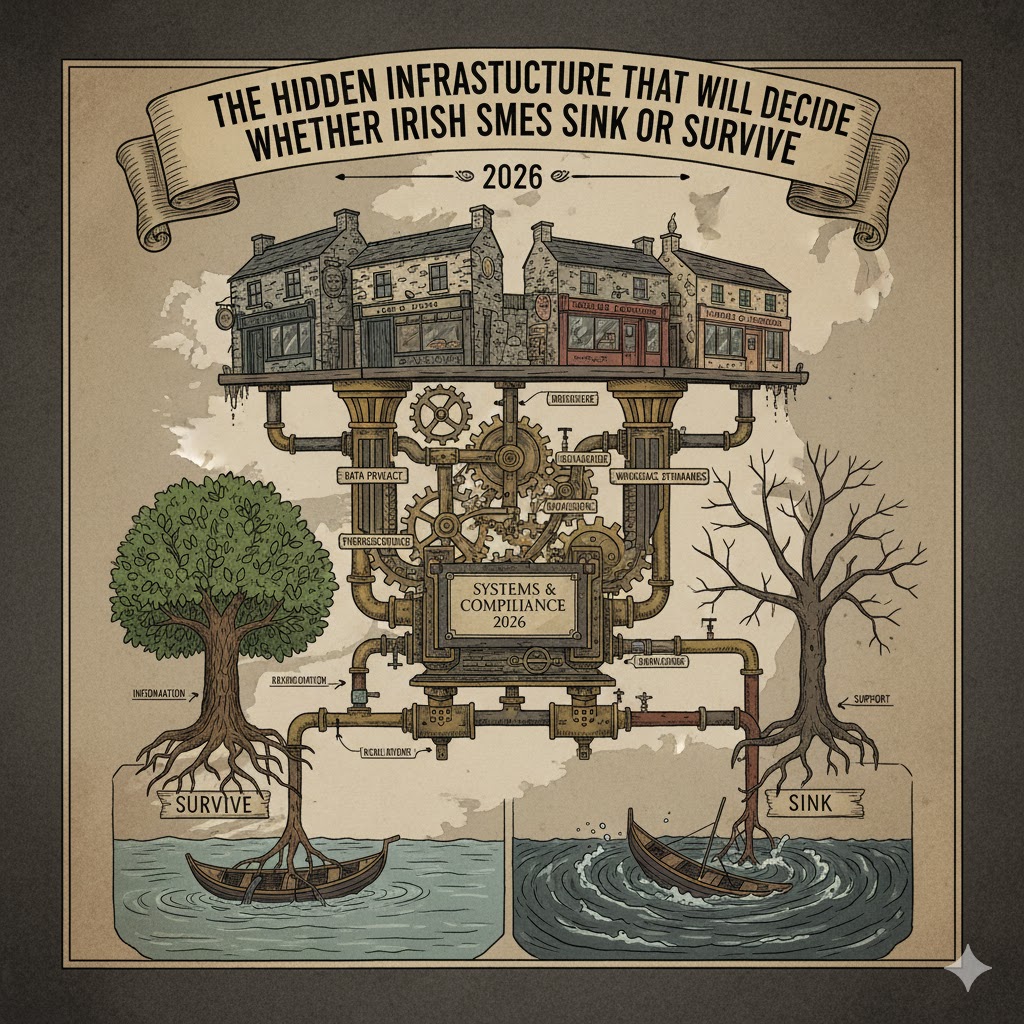

Systems & Compliance in 2026: The Hidden Infrastructure That Will Decide Whether Irish SMEs Sink or Survive

Published: December 2025

Author: Amergin Consulting Ltd.

Target Audience: Business Owners, Finance Managers, and Small Business Seeking Financial Stability

Book a meeting: https://calendly.com/amergin-group_free/30min

Integration, documentation, CSRD pressure, travel policies, and the new compliance reality facing Irish businesses.

Running a business in Ireland has always meant dealing with compliance, but the nature of that compliance the volume of rules, the expectations around data, the speed of reporting, the visibility of errors has changed dramatically in the last five years. Payroll is now real-time. Revenue reporting is moving towards instant cross-checking. Employment legislation has expanded in scope. Sustainability demands are trickling down supply chains. Internal policies are no longer seen as “big company luxuries” but as essential documents expected of businesses of all sizes.

By 2026, Irish SMEs will find that compliance is no longer a side-task tucked into the end of each quarter. It has become an operational pillar, woven into the way a business runs every single day. The SMEs that succeed in this environment won’t necessarily be the biggest or busiest they’ll be the ones with structure. The ones whose systems actually talk to one another. The ones whose records make sense. The ones whose internal processes don’t fall apart when something unexpected happens. In short: the ones who build a strong Systems & Compliance foundation before they’re forced to.

To understand what this means, and why 2026 is a turning point, we need to step inside the real world of Irish SME operations into the interplay between payroll and bookkeeping, the growing influence of CSRD, the messy world of travel and subsistence records, and the increasing need for documented internal policies around sick pay, leave, flexible work, Auto-Enrolment and employee entitlements. Compliance is no longer a box to tick. It's the framework through which Revenue, clients, partners and even banks now assess whether a business is credible, reliable and worth dealing with.

Integration: Why Payroll and Bookkeeping Must Finally Speak the Same Language

For years, SMEs treated payroll and bookkeeping as two separate universes. Payroll lived in its own world often managed by one person, in one system, with its own files and logic. Bookkeeping lived elsewhere sometimes with a separate person, a separate piece of software, a separate set of assumptions. As long as both areas “seemed fine,” nobody questioned the divide.

But 2026 will not allow that separation anymore. The Irish tax system has become too interconnected. PAYE data now flows into Revenue systems daily. Payroll submissions influence how Revenue interprets VAT patterns, corporation tax profiles and benefit structures. Expenses that travel through payroll must align with accounts. Travel and subsistence payments have been pulled into real-time reporting. Auto-Enrolment contributions must be reflected in both payroll and financial statements. Statutory Sick Pay feeds into payroll accuracy, which feeds into bookkeeping categorisation, which feeds into PAYE reporting.

When payroll and bookkeeping operate in isolation, inconsistencies emerge quietly, then compound loudly. A payroll figure doesn’t match the accounts. A benefit is taxed incorrectly. A travel payment is coded one way in payroll and another way in bookkeeping. A pension contribution doesn’t reconcile. A sick day calculation doesn’t align with the wages posted for the week. And because Revenue now analyses everything holistically, each inconsistency becomes a signal a small indicator that something underneath may be out of sync.

The businesses that thrive in 2026 will be the ones whose systems are integrated where payroll entries flow directly and cleanly into accounting software, where expense categories match payroll codes, where pension deductions reconcile automatically, and where every number aligns because the systems behind them align. Integration eliminates the cracks that compliance falls through. It removes the internal friction that leads to errors. It replaces manual work with predictable, consistent processes.

In the years ahead, system integration will not be a technical choice it will be a compliance requirement.

CSRD Pressure: Why Sustainability Reporting Will Reach SMEs Sooner Than Expected

Many SMEs assume that sustainability reporting begins and ends with large multinationals. They’ve heard of the Corporate Sustainability Reporting Directive (CSRD), but dismiss it as something for banks, global brands or listed companies. But the reality in 2026 is very different. Even though SMEs are not directly required to file CSRD reports, they will increasingly find themselves being asked for sustainability-related information by their customers, partners, investors and suppliers.

This is because CSRD creates a cascading effect: large companies must report on their supply chains. And that supply chain includes SMEs cleaning companies, recruitment agencies, consultants, caterers, tech developers, tradespeople, logistics firms, accountants, manufacturers, and any small business providing goods or services to a larger entity.

A Dublin SME that sells packaging to a major retailer may be asked for environmental data. A professional services firm working with a tech multinational may be required to provide workforce diversity details or governance documents. A logistics company may be asked to disclose emissions-related information. Even a small service provider that never considered sustainability as part of their operations may begin receiving questionnaires requesting policies on anti-corruption, human rights, equality, or energy usage.

CSRD is not just about carbon footprints it is about governance, transparency, fairness, policies, supply-chain integrity and organisational structure. A company that cannot produce even basic documentation risks being excluded from supplier lists, overlooked in tender processes, or deprioritised in contract renewals.

In 2026, SMEs will begin to feel this pressure not through legislation, but through commercial necessity. Preparing for CSRD requests means having documented internal practices, clear processes, and a finance function that can produce data consistently. It means knowing how your business operates beyond the day-to-day, and being able to explain that operation credibly. For many SMEs, this is the first time they will need to articulate policies they have had informally for years policies on sick leave, flexible work, travel rules, expense entitlement, environmental practices, or staff training but never documented.

Compliance is no longer about obeying Revenue alone. It is about meeting the expectations of the ecosystem your business depends on.

The Quiet Problem in Every SME: Travel and Subsistence

Travel and subsistence has always been one of the messiest areas of SME compliance. Employees claim expenses in inconsistent ways. Receipts go missing. Mileage is estimated rather than recorded. Meals appear without explanation. Coffee runs blur with client meetings. Travel days overlap with remote work days. And because Enhanced Reporting Requirements have pulled many of these payments into real-time Revenue review, travel and subsistence processes must evolve.

In 2026, Revenue will be paying close attention to expense patterns. They will notice when mileage claims are unusually high, when staff appear to be claiming contradictory allowances, when subsistence doesn’t match the nature of the work, or when records lack sufficient detail. SMEs that treat travel and subsistence casually whether due to trust, habit, or simply lack of time will find that the gap between informal practice and regulatory expectation has widened.

A travel policy is no longer optional. It is essential infrastructure. Employees need clarity on what they can claim, when they can claim it, how to record it, and what documentation they must provide. Employers need a system that tracks these claims transparently and aligns them with payroll and bookkeeping. Without this structure, errors will not just affect expenses they will spill into VAT, PAYE, company accounts and compliance exposure. Travel and subsistence has become an intersection point between multiple systems. To handle it poorly is to jeopardise all of them.

The New Compliance Standard: Documented Internal Policies

Irish SMEs have traditionally operated with unwritten rules. Everyone “just knew” how things worked. If someone needed sick leave, they emailed their manager. If someone worked from home, they arranged it informally. If the company paid a travel allowance, the logic behind it lived inside one person’s head. In many ways, this informality created efficiency fewer forms, fewer bottlenecks, less red tape.

But in the compliance environment of 2026, informal rules are becoming liabilities.

The Work Life Balance Act has introduced new entitlements and new responsibilities for employers. Statutory Sick Pay has moved from a vague norm to a defined obligation with clear calculations and documentation requirements. Auto-Enrolment will introduce new pension structures, opt-out conditions, communications duties and record retention rules. Flexible work, remote work, leave policies, parental rights, and workplace protections are no longer optional policies they are required elements of a functioning business.

When these policies are undocumented, several risks emerge. Employers make inconsistent decisions because they are relying on memory instead of process. Employees receive conflicting information. Managers interpret rules differently. Payroll miscalculates entitlements. Bookkeeping miscodes transactions. Revenue queries become difficult to defend. Legal exposure increases in the event of a dispute. And auditors, investors or corporate clients may view the absence of documented policies as a governance weakness.

Documentation does not mean bureaucracy. It means clarity. It means fairness. It means predictability. It is the foundation upon which modern workplace compliance rests.

Systems & Compliance: The Invisible Framework Behind a Stable SME

When we work with SMEs across Ireland — whether in hospitality, trades, professional services, technology, logistics or retail we often find that their real challenges are not the dramatic ones. They are the quiet ones. A payroll report that doesn't match the accounts. An expense policy nobody remembers writing. A CSRD questionnaire nobody knows how to answer. A VAT return that doesn’t align with the underlying data. A sick pay question that nobody can resolve confidently. These are not failures of intention. They are failures of structure.

2026 will reward the SMEs that build structure now. Not complex structures, but clear ones. Integrated systems rather than scattered tools. Documented policies rather than unwritten norms. Consistent workflows rather than improvised habits. Compliance that supports the business rather than slows it down.

When payroll and bookkeeping integrate, errors disappear before they become problems. When travel and subsistence have a clear process, Revenue queries become easy to handle. When internal policies are documented, fairness and consistency become strengths rather than risks. When CSRD requests arrive, you are already prepared rather than scrambling.

In a year where Irish SMEs face more change than at any point in recent memory, structure becomes the lifeline.

Conclusion: Compliance Isn’t Getting Easier , But It Can Get Simpler

Compliance in 2026 will feel heavier for Irish SMEs, but it doesn’t have to feel chaotic. The pressure comes from complexity, not from inevitability. And complexity can be reduced when systems speak to each other, when rules are written down, when data is consistent, when people know what to do, and when support is available.

At Amergin, we help SMEs build the systems and compliance foundations that transform finance from a source of stress into a source of stability. We connect payroll to bookkeeping. We design clear policies and processes. We help businesses prepare for CSRD expectations. We fix travel and subsistence routines. And we create an environment where compliance is not a monthly panic, but a daily calm.

The businesses that thrive in 2026 won’t be the ones that work the hardest they will be the ones that work with structure. If you want help building that structure, Amergin is ready to walk you through it.

About Amergin Consulting Ltd.

Amergin Consulting Ltd. is a Dublin-based chartered accountancy and business advisory firm serving Ireland’s SMEs and growth companies across construction, technology, professional services, and renewable energy.

We specialise in Accounting, Payroll, Taxation, and CFO Services that help businesses build stronger foundations for profit and compliance.

Need help running a year-end tax review or planning your 2026 payroll changes?

Amergin Consulting’s finance and tax team can help you identify deductions, forecast cash flow, and ensure full compliance before the year closes.

Book your 30-minute consultation: https://calendly.com/amergin-group_free/30min

Disclaimer

This article is for general informational purposes only and does not constitute financial or tax advice. While every effort has been made to ensure accuracy, Budget 2026 legislation may change upon enactment of the Finance Act 2025.

Public should seek professional advice tailored to their specific circumstances before acting on any points discussed.